-

Make Social Security part of your

retirement income plan .

Download Brochure -

A Wise Strategy May Get You More

Social Security Income .

Watch Video -

Do you need help planning for your

Social Security income?

Contact Me

Social Security retirement benefits help provide lifetime, inflation-adjusted income. Combined with your retirement savings, plus any pension benefits you may receive, Social Security may serve as an important component of your overall plan for retirement income.

Eligibility for Social Security begins "early", at age 62. However, claiming early will reduce your monthly check - permanently. There are many issues to consider when deciding to claim benefits.

Your Primary Insurance Amount, or PIA, is the amount of monthly income you will receive at your normal retirement age, also known as your Full Retirement Age (FRA). Depending upon when you were born, your FRA will range from age 65 to age 67. People born between 1943 and 1954 have an FRA of 66. Click here to see your FRA.

Your PIA, which is based upon your lifetime earnings, may be reduced or increased, depending upon when you decide to claim retirement benefits. You may claim benefits before reaching your FRA, as early as age 62, and you may delay claiming until after your FRA, as late as age 70.

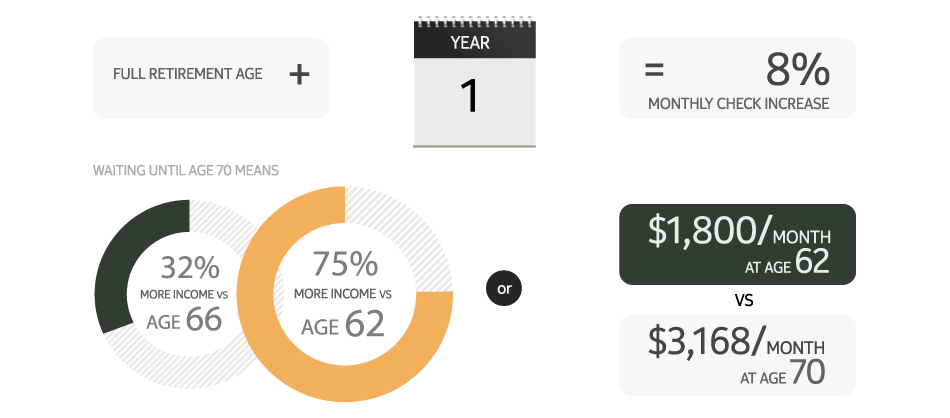

Claiming after you've reached your FRA offers benefits. Your monthly check will be increased by 8% for each year that you delay, up to age 70. For example, if your FRA is 66, and you delay four years until you're 70, your monthly check will be 32% higher than at age 66, and 75% higher than at age 62. Over time, one might receive significantly more dollars depending upon when benefits are claimed.

You may benefit from seeking the advice of a financial advisor that focuses on retirement income planning, one who can help incorporate your Social Security claiming options into an overall retirement income plan.

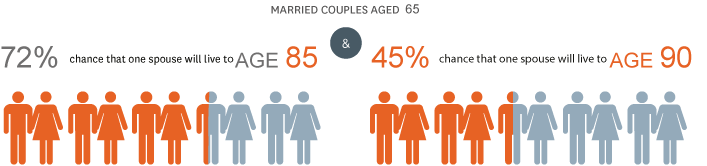

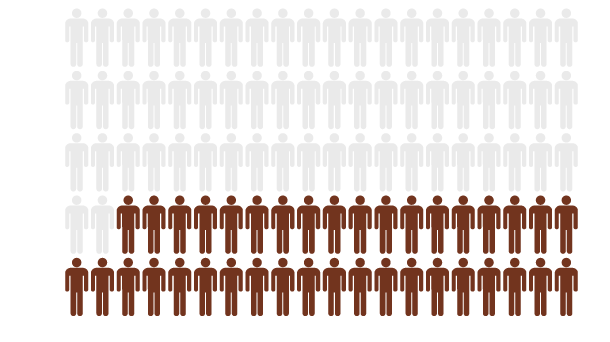

Have you ever thought about how many years you might spend in retirement? While we can't know for certain, we should think about how life expectancy has increased in the decades since Social Security began.

In 1935, life expectancy in the U.S. was 61.7 years.

By 2016 it had increased to 78.6 years. *

Consider a married couple age 65. There's a 72% chance that one spouse will live to age 85. And a 45% chance that one spouse will live to age 90. **

As of December 2017 ***, 5.7 million Social Security beneficiaries were at least age 85. Some much older. But collecting Social security benefits well into old age is nothing new.

Source: * Data Brief 293, 12/17

Source: ** Calculation based on mortality data from Society of Actuaries Retirement Participants 2000 table

Source: *** Social Security Administration Facts and Figures about Social Security, 2017

The very first person to collect Social Security retirement benefits was named Ida May Fuller.

A resident of Vermont, Ida May retired in 1939 after paying into Social Security for just three years. Ida May received her first Social Security payment on January 31, 1940. She then went on to collect from Social Security for thirty-five years.

Ida May passed away in 1975... at the age of one hundred.

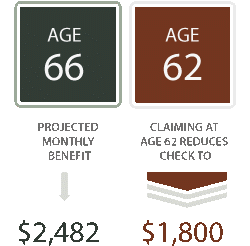

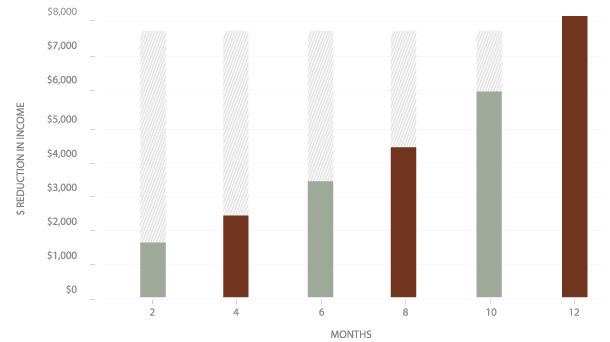

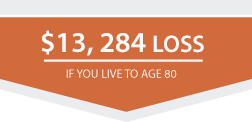

Let's assume that your age 66 projected monthly retirement benefit is $2,482. Claiming benefits at age 62 reduces the monthly check from $2,482, to $1,800.

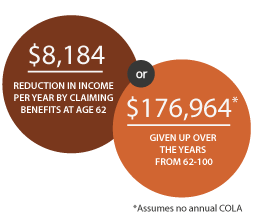

That's a reduction of $8,184 per year. Again, that reduction is not for a year, or a few years. It's PERMANENT.

Over the 38 years from age 62 until age 100, this means giving up one-hundred-seventy-six-thousand-nine-hundred-sixty-four-dollars.

Now, you may feel that living to age 100 is unrealistic. If so, then back that up by 20 years. If you were to live to age 80, the loss in retirement income is still $13,284.

Don't automatically think that claiming Social Security benefits early is your best decision.

It may have been the right choice for your parents, but it could be the wrong choice for you.

In fact, if you feel that you are likely to live to age 80, or, 85, you should think carefully about delaying benefits until even after your full retirement age. This is because for every year that you wait beyond full retirement age, your monthly check will be increased by an additional 8%.

Waiting until age 70 means receiving 32% more retirement income versus age 66, and 75% more income compared to age 62. That's $1,800 per month at age 62, versus $3,168 at age 70.

Although the difference in these two numbers is dramatic, it's only one factor in choosing the Social Security claiming strategy that's best for you.

The opportunity to receive a higher monthly income helps explain why proper retirement income planning is important. It also points out why a well-designed retirement income plan shouldn't overlook how to maximize Social Security benefits.

Your need for income and views about life expectancy are just two of many important factors in determining when to receive benefits.

Did you know that Social Security lets you see your benefits online? Visit My Social Security to learn how much retirement income you will receive.

The case studies below illustrate how a wise claiming strategy can help you get the most from Social Security.

The longer you wait to claim Social Security the greater the benefit amount that will be paid. For each year you don't claim benefits you would otherwise be eligible for from age 62 to age 70, payments can increase by up to 8% a year.

You may want to consider this strategy if you feel it's likely that you could live an average to above average life expectancy and you and your spouse have similar earnings histories. A downside is that waiting to claim Social Security may cause you to tap into retirement assets earlier to “bridge” to the later claiming date.

Let's assume Hank will live to age 88 and Susan will live to age 90, their incomes are $75,000 and $70,000 respectively.

If Hank and Susan both claim at age 62 they would receive a combined lifetime benefit of $1,100,000. But if they live to be ages 88 and 90, respectively, deferring to age 70 would mean about $250,000 in additional benefits.

* All lifetime benefits are expressed in today's dollars, calculated using life expectancies of 88 and 90 for husband and wife, respectively. The numbers are sensitive to life expectancy assumptions and could change.

As most folks are aware you can file for reduced Social Security benefits at age 62. If you and your spouse are concerned you may have a shorter time horizon due to health issues, filing earlier may make sense. If you don't feel that at least one of you could live into their late eighties then filing earlier may be a good option to consider.

Hank is 64 years old and feels like living to age 78 is reasonable, he currently earns $70,000 annually. Susan his spouse is 62 and feels she could live until age 76. She is the higher earner in the family at $80,000 annually.

By claiming at their current age, Hank and Susan are able to increase their lifetime benefits. Compared with deferring until age 70, taking benefits at their current age, respectively, would yield an additional $113,000 in benefits—an increase of nearly 22%.

* All lifetime benefits are expressed in today's dollars, calculated using life expectancies of 78 and 76 for husband and wife, respectively. The numbers are sensitive to life expectancy assumptions and could change.

When a spouse dies the surviving spouse is entitled to receive the higher of the two benefits previously received. This ensures the largest benefit check continues while the lesser benefit ceases. Although this is a great benefit, some couples do not consider the loss or reduction of a benefit check on the surviving spouse. If you take your social security benefits early this will permanently impact your survivor benefits.

You may want to consider this option if you and your spouse have different benefit amounts and believe at least one of you could live a full life expectancy, outliving the other.

Hank & Susan are both about to turn age 62. Hank expects to get $2,000 a month from Social Security when he reaches age 66 ½. He feels he is in good overall health and should reach average longevity for a man his age, which is around 85. Susan will get a $1,000 spousal benefit at age 66 1/2 and, based on her health and that both of her parents lived to over age 95, that living to an above-average age of 94 is quite possible .

As an alternative to full retirement age, Hank and Susan are considering retiring at 62, when he would get $1,450 a month, and she would get $725 in benefits. Claiming early will cause their monthly benefits to be reduced by 27.5% over their full benefit available at age 66 ½. In addition, taking payments at age 62 would reduce Susan's benefits during the 9 years she expects to outlive him.

If Hank waits until he's 66 ½ to collect benefits, he'll get $2,000 a month. If he delays his claim until age 70, his benefit—and his Susan's survivor benefit—will increase another 28%, to $2,560 a month. Waiting until age 70 will not only boost his own future cumulative benefits, it will also have a significant effect on his wife's benefits. In this hypothetical example, her lifetime Social Security benefits would rise by about $69,000, or 16%.

* Social Security payout figures are in today's dollars and before tax; the actual benefit would be adjusted for inflation and possibly subject to income tax.

All hypothetical examples here were calculated using benefit calculators provided by the Social Security Administration and can be found here: https://www.ssa.gov/benefits/calculators

Claudia is divorced and is wondering what options she has to claim Social Security benefits. She will first need to meet the eligibility requirements below.

• She must have been married for 10 years or longer.

• She cannot be currently married.

• You must be age 62 or older.

• If your ex is deceased, you can collect at age 60 as a surviving divorced spouse.

• If your ex is deceased and you are disabled, you can collect at age 50.

If Claudia meets these hurdles then she would be able to file based on her ex-husbands record. She would not have to wait for her ex-spouse to first file for his own benefits and is eligible to receive 50% of their benefit amount. As a caveat if your ex-spouse dies before you then you would be eligible for 100% of their benefit amount. Your divorced benefit is limited to your ex-spouses full retirement benefits and will not accrue any delayed retirement credits. Meaning there is no benefit for you to wait to claim beyond your full retirement age (FRA).

• No, your ex-spouse will not be notified that you file and receive benefits.

• Yes your ex can collect on your record if you are eligible to collect on theirs.

• Can I collect on more than one ex-spouse? No, only the largest benefit will be paid if you have more than one eligible ex.

Please use my contact form

Wealth2k

75 Arlington St Ste 500

Boston, MA 02116

Telephone: 800.200.9404

Fax: 781.730.0706

Email: info@wealth2k.com

Website: WWW.SAMPLE.RETIREMENTTIME.COM

|  |